Discussing Politics and the Markets is Smart, Not Taboo

By Adam Roberts, AIF®, CFP®

03/25/24

From an early age, Americans are taught to avoid discussing politics and religion. This adage has been passed down for generations, as these deep-seated topics often stir up heated, or even volatile, situations.

But as we are in the midst of an election year, we’re tossing social graces aside because it’s important and smart to discuss whether politics affect the economic markets.

More than 40% of the world’s population will head to the polls in 2024. This makes up nearly 80% of the global market cap.1

Democrat or Republican: Which do the markets prefer?

As financial advisors, we’re often asked how the markets are affected by presidential elections:

“Are we doomed because my party is no longer in office?”

“Will things finally turn around because my party prevailed?”

“Which party will help the markets more?”

The short answer is, the markets do not care.

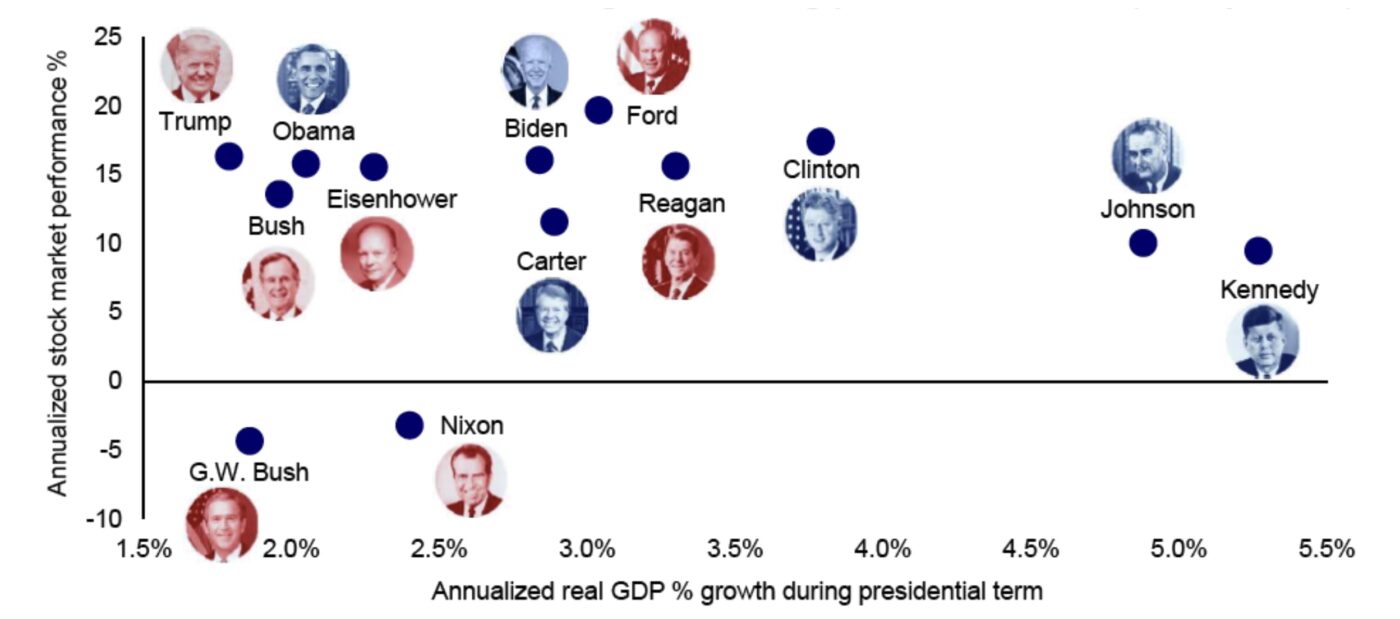

For the long answer, let’s start with chart A, which compares stock market returns to economic growth during each presidential administration since 1957. Chart A illustrates that while both parties have had ups and downs, neither has emerged as superior. In fact, all but two administrations saw positive returns. The two outliers, Nixon and G.W. Bush, each had negative GDP growth coupled with negative returns — of course, both of these administrations were plagued by deep recessions.

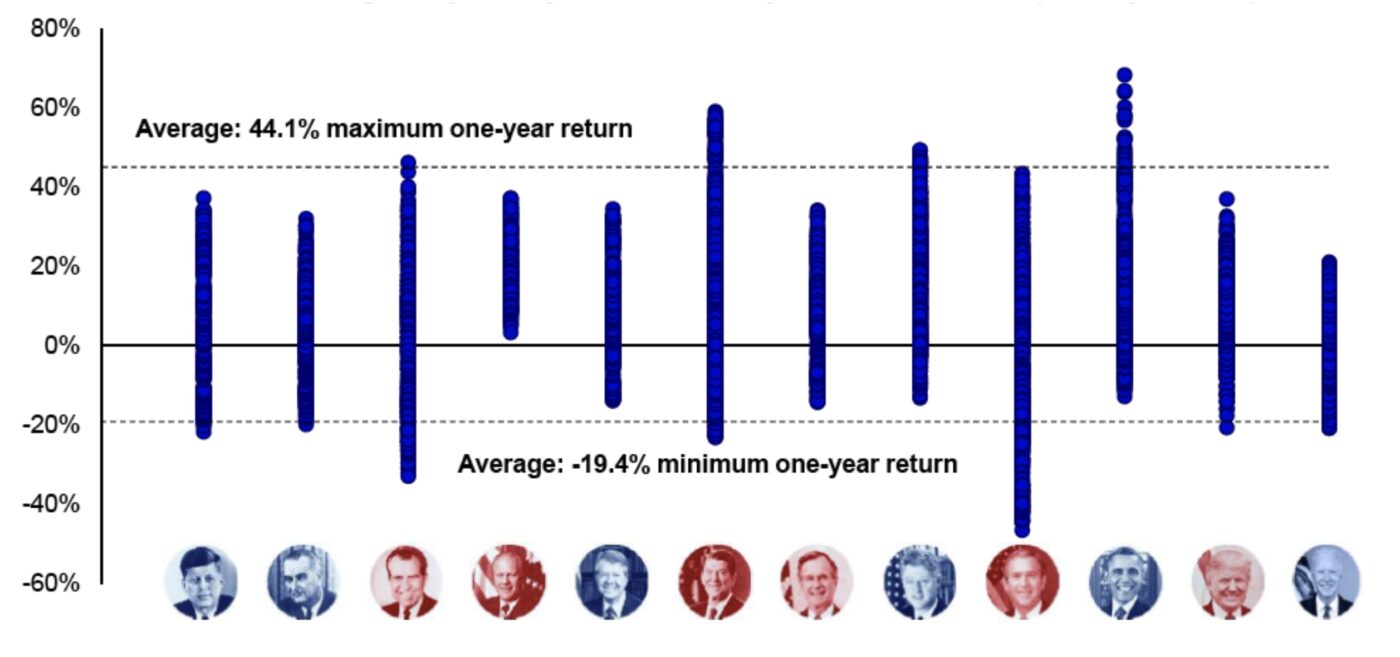

If chart A isn’t convincing enough, just look at chart B. When we compare the one-year trailing S&P 500 returns for each administration, they are all quite similar. Once again, neither party can claim they’ve outperformed the other.

Chart A:

Stock market returns vs. economic growth during presidential terms (1957 – present)2

Source: Haver, Invesco, 9/30/23

Chart B:

S&P 500 Index: Rolling daily one-year returns by administration (1961 – present)3

Source: Haver, Invesco, 9/30/20

What actually affects the markets?

So, if the political party doesn’t affect market returns, what actually does? The Federal Reserve has the most power to affect market conditions. Charged with maintaining stable employment and minimizing inflation, the Fed’s primary tool is to adjust interest rates. And then the markets respond to the interest rate hike or reduction.

Take 2024 as an example. The Fed has indicated interest rate reductions are coming, and the markets have already responded favorably. In fact, we expect the anticipated cuts to be the leading factor for a positive stock market in 2024. Of course, whoever wins the election will likely claim this victory, but it’s not actually theirs to claim.

Leave the volatility for the politicians

Both parties have had a history of positive and negative years in the market. The good news is, election years are generally positive for the stock market. For example, going back to 1992, six of the eight election years posted positive returns.

Looking ahead to the second half of 2024, we continue to be optimistic. And as we watch what’s sure to be a volatile political season, let’s hope the volatility remains in the political realm and out of the economic markets.

1. Yates, Trevor. 2024 Elections: Unlocking Potential Opportunities in Emerging Markets. Global X Insights, February 21, 2024.

2. Biden’s stock market performance data is from 1/20/21‒9/30/23. Eisenhower’s second term only is shown. Real GDP data is from 12/31/2016‒6/30/2023 because GDP is reported with a lag. Stock market performance is defined by the S&P 500 Index total return. An investment cannot be made in an index.

3. Real GDP data for Trump is from 12/31/2016‒3/31/2020 because GDP is reported with a lag. It doesn’t reflect the economic decline experienced during Q2 2020. Trump stock market performance data from 1/20/17‒9/30/20. Stock market performance is defined by the S&P 500 Index total return. An investment cannot be made in an index.

Past performance does not guarantee future results. Investing involves risk and the potential to lose principal.

The provided information is for educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in any particular strategy. There is no guarantee that any forward-looking statement will come to pass.

The content is developed from sources believed to be providing accurate information. Potentia and Potentia Wealth do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Investment advice offered through Mariner Independent Advisor Network, a registered investment advisor. Mariner Independent Advisor Network, Potentia Wealth, and Potentia are separate entities.

©2024 Potentia Inc.