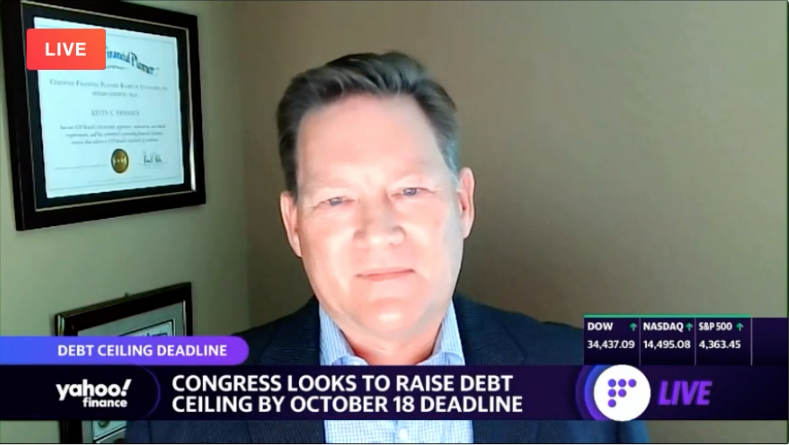

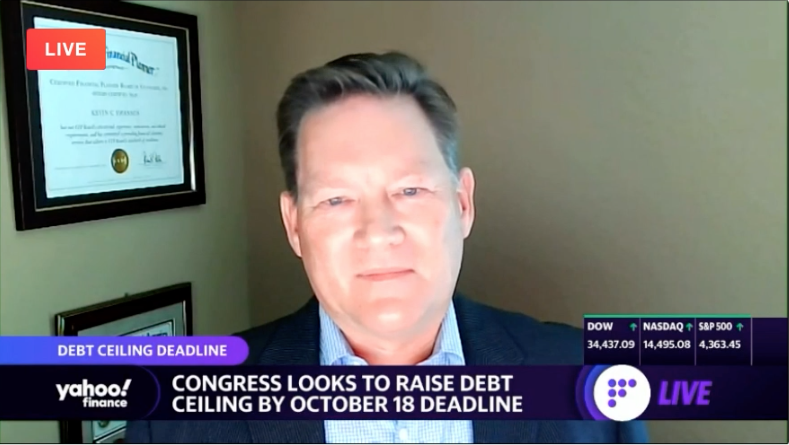

The U.S. Congress is currently at a crossroads: either raise the debt ceiling by October 18 or have the Treasury default for the first time in history. To learn more about the current debt ceiling showdown and its potential impacts on the markets and investors, Yahoo Finance LIVE recently turned to Potentia Wealth CEO, Private Wealth Advisor and LPL Registered Principal Kevin Swanson for insight.

According to Swanson, investors should be considering three specific things as we experience volatility leading up to the debt ceiling deadline. The first is keeping an emergency fund aside to cover four to six months of expenses. The second is looking at our risk tolerances and rebalancing portfolios back into alignment. Lastly, he recommends holding onto any extra cash and waiting for the opportunity for corrections over the next few months.

“This may be an opportunity for us to take advantage of some corrections in the market in the next couple of months with some additional volatility around the debt ceiling and for us to purchase good equities at a discount to today’s prices,” Swanson explains.

Even if the debt ceiling does not get raised and a default occurs, history tells us that investors should not be too concerned about the long-term health of the markets – and Swanson agrees.

“If we go back to 2018, we have the longest shut down in history at that point at just over thirty days and the S&P lost 6 percent that year,” says Swanson. “We had a twenty percent correction in the market. Fortunately, the following year we had a twenty-nine percent return. So, while we do see market volatility and potential short-term corrections in the market due to the shutdowns and the uncertainty around those, we do have the tendency to keep positive markets longer term.”

However, Swanson cautions that there are some concerns for retirees depending on social security and other government benefits.

“The debt ceiling is the total amount of money that the U.S. government is authorized to borrow to meet those existing legal obligations – that includes Medicare benefits, military salaries and social security,” he says. “All of those payments could be postponed if the Treasury needs to pay the debt.”