Managing Market Twisties

By Potentia Wealth

08/10/21

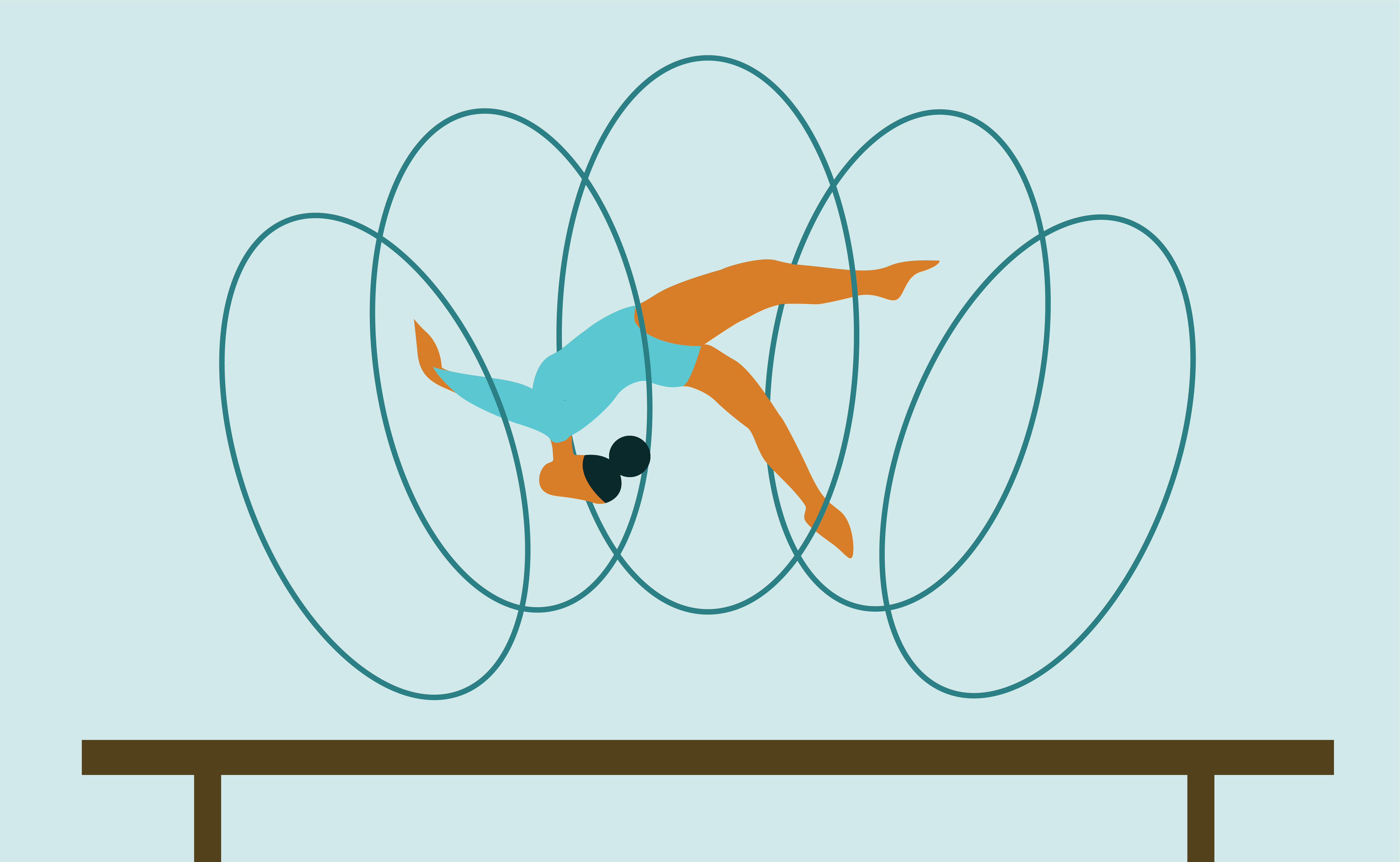

The “Twisties” is a mental block when an athlete loses their spatial awareness during an intense routine. The term is little-known outside the world of professional gymnastics and brought the four-time Olympic champion Simone Biles down on July 28, causing her to temporarily pull out of this year’s competition. It is widely experienced by gymnasts performing dizzyingly quick routines and many find it terrifying. Investors experience something similar in volatile markets.

Along with high-frequency market trading, computer-driven analytic trades and the recent Memes stock trades, we have seen more and more dazzlingly quick moves in the stock market which many investors find terrifying. Individual investors typically experience “Market Twisties,” freezing while the market goes through its backward somersaults, aerial walkovers and handsprings. Then, unable to release the losers in their portfolios, they continue to hold onto investments that should at least be temporarily pulled, hoping that they will come back with a gold medal performance. Often, this is not the case.

Back in the late 90s, I had a CPA client who persistently refused to diversify his concentrated position in tech stocks. We all know what happened in the early 2000s with the .com bust. Early in that market correction, it was recommended that he release those stocks however, experiencing the “Market Twisties,” he was frozen with uncertainty. His tech stocks portfolio lost over 50% by the end of 2002. During the recovery, we made recommendations for other equity holdings that we felt would recover better than the tech stocks that he held. He was absolutely sure that these were good companies and that they would eventually come back. Twenty years later, some of those stocks are still below their 1999 values.

At Potentia Wealth, our portfolio managers have a written de-risking policy and are actively managing our client portfolios. We set risk/return criteria for our clients’ portfolio sleeves constantly monitoring their performance. Like Simone Biles, when something is not performing as expected, we make the hard decision to pull it from the portfolio lineup, at least temporarily.

Even the most decorated gymnasts can lose perspective when tumbling through the air, and the most confident investors can also lose perspective when the market skyrockets up or tumbles down. Having an objective advisor can help you keep your feet on the ground and save you – and your portfolio – from the effects of the “Market Twisties.”

Important Information:

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.