Put Your Oxygen Mask on First: Preparing for Volatility

By Todd Barney, CIMA®, CPWA®, CFP®

02/11/25

Imagine you’re on an airplane with the people you love most. The flight is smooth, and the seatbelt sign is off. But suddenly, turbulence hits and oxygen masks drop from above. What do the flight attendants tell you? “Put your oxygen mask on first before helping your loved ones.” This simple rule ensures you’re calm, focused, and able to act wisely. And that’s the mindset we need when markets get volatile.

Today, we’ll explore how being thoughtful and prepared during turbulent times is essential for long-term investing success. By looking at historical patterns of market behavior, we’ll see how to keep your emotional “oxygen mask” on and avoid rash decisions. Because, unfortunately, impulsive financial decisions can hurt you, as well as those you love most.

Historical perspective: The temporary nature of market volatility

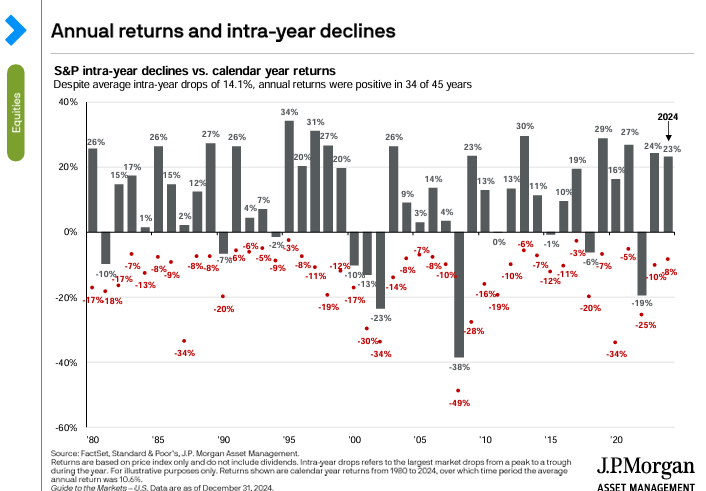

The chart titled, “Annual returns and intra-year declines,” shows annual S&P 500 returns alongside the biggest drops experienced during each year from 1980 to 2024. Since 1980, the average intra-year drop was 14.1%. In other words, markets tend to decline significantly at some point during the year. Yet, despite these drops, annual returns were positive in 34 of the past 45 years.

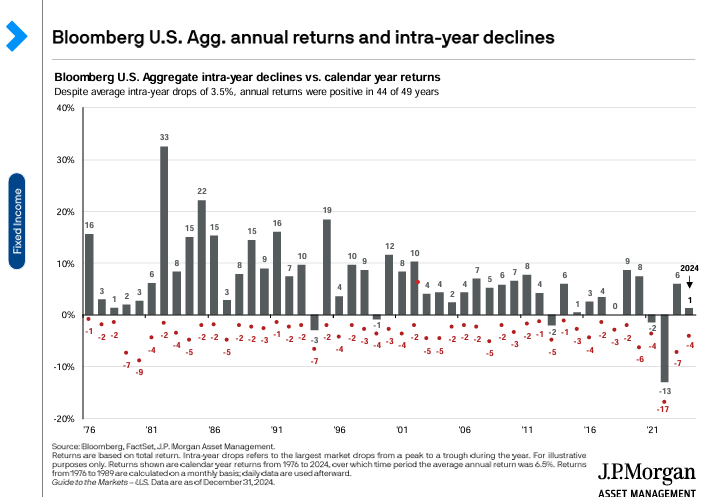

The next chart, titled “Bloomberg U.S. Agg. annual returns and intra-year declines,” highlights similar data between 1976 and 2024 for the Bloomberg U.S. Aggregate Bond Index, which represents fixed income investments. Like stocks, bonds also typically experience intra-year declines, though much less severe. While the average intra-year drop was 3.5%, annual returns were positive in 44 of the past 49 years.

This historical data remind us that market turbulence is normal — within both the stock and bond markets — but it’s also temporary. And, just like on an airplane, knowing what to expect helps you stay calm and act with clarity.

Turbulence is uncomfortable, but it’s a normal part of the journey.

What causes market volatility?

Market volatility is driven by many factors, including economic shifts, geopolitical events, interest rate changes, and investor emotions. While some turbulence can be anticipated — such as a recession or rising interest rates — other events come without warning. Think of situations like the COVID-19 pandemic or the 2008 financial crisis.

Despite these episodes, the markets have historically recovered. The S&P 500, for example, has weathered wars, recessions, and many other crises. Yet, it has consistently rewarded patient investors over the long term. The Bloomberg U.S. Aggregate Bond Index adds another layer of stability to client portfolios. And while bonds may not offer the same growth potential as stocks, their lower volatility can provide peace of mind and help balance overall risk.

The key is to keep your oxygen mask on — to stay thoughtful and avoid emotional decisions. Because although turbulence is uncomfortable, it’s a normal part of the journey.

Lessons from the past help us stay the course

Let’s consider a few historical lessons that remind us to stay the course during turbulent markets.

- Put your mask on first. When turbulence strikes, focus on your own well-being — or, in investing terms, focus on your plan. By expecting market declines, you’re less likely to panic. And, remember, the average intra-year drop in the S&P 500 was 14.1% over the past 45 years. But years with significant intra-year drops often end with positive returns — like in 2023 and 2024. In anticipation of market turbulence, our team has been increasing bond holdings to provide more interest income and mitigate volatility.

- Keep your eyes on the destination. Just as flight crews encourage passengers to stay seated and composed, we should remain calmly focused on our long-term goals. Historical data show that time in the market is more important than trying to time the market. Overreacting to short-term declines can lead to missed opportunities for growth. And this is why having a financial strategy is critical. For example, we’ve invested in data centers and cyber security because we expect these areas to grow for years to come, regardless of short-term volatility.

- Diversify your safety net. Diversification is like having multiple oxygen masks within reach. By spreading your investments across asset classes, such as stocks and bonds, you reduce the impact of volatility. Bonds, for example, tend to experience smaller drops than stocks, providing stability when equity markets are choppy. Potentia builds diversified client portfolios by blending three investment components: (1) core equity, (2) stable fixed income, and (3) thematic opportunities that pursue sector-specific trends.

Practical tips for navigating volatility

Market volatility is inevitable, so the smart thing to do is take practical steps to prepare for it.

- Revisit your financial plan. During our meetings, we review and adjust your investment strategy to keep it on track with your current goals and circumstances. But if market volatility raises questions for you, let’s sit down and revisit your plan to make sure you’re comfortable.

- Rely on your emergency fund. You’ve worked hard to have cash set aside for emergencies. This provides peace of mind and reduces the temptation to sell investments during market downturns. And by having a safety net in place, you won’t feel forced to sell assets when prices are low.

- Avoid emotional decisions. Just as passengers are advised to stay seated and buckle up during turbulence, investors should resist the urge to make sudden moves. Emotional reactions often lead to poor investment decisions. Instead, remind yourself of the historical resiliency within financial markets.

- Stay informed, but not obsessed. Keeping an eye on your investments is important, but checking too frequently can amplify anxiety. Markets fluctuate daily, but the long-term trend is what matters most.

- Work with us. Your Potentia advisor is on the journey with you, providing valuable perspective during volatile times. We can act as your co-pilot, helping you make decisions based on strategy rather than emotion.

Embracing the journey

Investing isn’t about avoiding turbulence. It’s about navigating through it. By keeping your emotional oxygen mask on — staying calm and focused — we can make thoughtful decisions that help us stay on track for your financial goals.

Remember, no turbulence lasts forever. In fact, clear skies often follow the roughest patches. By staying disciplined and focused on your long-term objectives, you can ride out the bumps and emerge stronger on the other side. So, fasten your seatbelt, trust the flight plan, and know that your partners at Potentia Wealth are with you every step of the way.

The provided information is for educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in any particular strategy.

The content is developed from sources believed to be providing accurate information. Potentia and Potentia Wealth do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Advisory services offered through Potentia RIA, LLC, an SEC-Registered Investment Advisor. Potentia RIA, Potentia Wealth, and Potentia are separate entities.

©2025 Potentia Inc.