Quarterly Investment Update: 1st Quarter 2025

By Austin Cua, CFP®

04/11/25

Have you ever experienced the feeling of déjà vu — when a situation feels familiar, yet you know it’s new? The literal translation of this French phrase to English is “already seen.” And while some people find the sensation of déjà vu intriguing, others find it unsettling, and still others find it comforting.

Déjà vu can be comforting

As we’ve watched the volatile markets this week, we’ve felt some déjà vu — today’s markets feel familiar to past markets, yet different at the same time. And while market volatility isn’t something we enjoy, we can take comfort in knowing how it has played out in the past.

Before we dig into understanding what happened during the first quarter of 2025, let’s keep top of mind that the market pattern is always the same — volatility, correction, recovery. And while we’ve said this many times before, it’s worth repeating: trying to time the market is dangerous. This fact is well illustrated in the chart titled, “Trying to miss the market’s worst days often results in missing the best days.” Over the past 30 years, the 15 best market days have all occurred during times of crisis. So our advice remains the same — stay the course.

Familiar echoes from the past

Market volatility and corrections shouldn’t surprise us — in fact, we should expect them. Over the past decade alone, we’ve had three significant market corrections and sell-offs.

- 2018 was a year filled with volatility and uncertainty. The S&P 500 reached an all-time high in January, but by February, trade tensions between U.S. and China caused the Federal Reserve to increase interest rates to curb inflation concerns. And by December, the S&P 500 reached bear market territory (down nearly 20% from its highs).

- 2020 saw the world shut down from the global COVID-19 pandemic. The S&P 500 plunged 34%, becoming the fastest bear market in history. In response, the Federal Reserve slashed interest rates to near-zero, and the CARES Act pumped trillions of dollars into the economy through stimulus checks. At year-end, the S&P 500 posted positive returns, at 16%.

- 2022 was plagued by rising inflation, which peaked at 9.1% — the highest we’d seen since November 1981. The Federal Reserve responded aggressively by increasing interest rates. The equity and bond markets both struggled: S&P 500 fell 19%, and the U.S. Aggregate Bond Index fell 13%.1

Whether it’s 2018, 2020, 2022, or 2025, each year brings its unique challenges. Yet challenges drive resiliency, and we’ve grown increasingly resilient by managing through market adversity.

Trade policy dominated Q1 2025

As we close out the first quarter of 2025, investor sentiment, corporate strategies, and global economic forecasts have all shifted in response to a wave of aggressive tariffs by the U.S. administration. Let’s take a closer look.

The White House announced a sweeping 10% tariff on all imports, with few exceptions, and additional “reciprocal” tariffs aimed at our key trading partners. This effectively raised the average U.S. tariff rate to above 25%, a level not seen since 1904. The justification? The belief that the U.S. is being overly charged with tariffs.

In response, some major trade partners created retaliatory tariffs. China has placed more retaliatory tariffs on all U.S. goods, while Canada has imposed tariffs on U.S. automobiles. Most countries, however, have expressed either caution or a willingness to negotiate terms.

Oversimplifying a complex situation

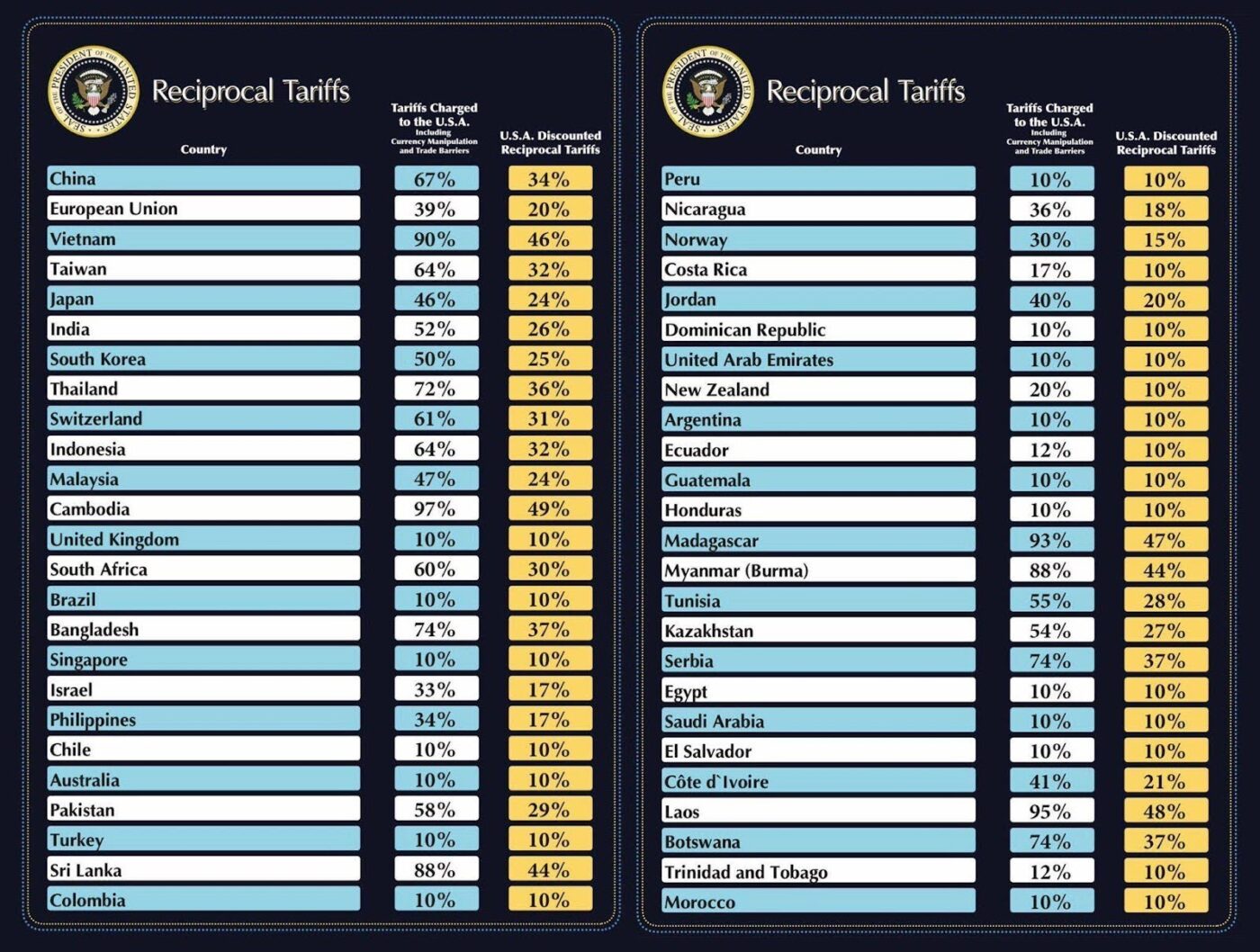

The Trump administration declared April 2, 2025, as “Liberation Day” and distributed a handout titled, “Reciprocal Tariffs,” which listed tariffs charged to the U.S., as well as U.S. discounted reciprocal tariffs.2

Some tariffs listed in Reciprocal Tariffs handout are indeed alarming. But are they accurate? For example, the handout claims a 39% tariff is charged by the European Union to the U.S., yet the World Trade Organization estimates the actual tariff is 2.7%. So, why the discrepancy?

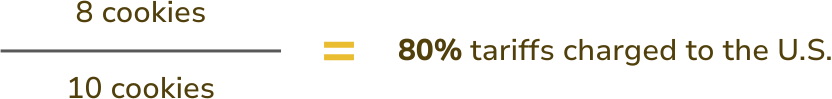

This is the formula used to calculate the figures in the Reciprocal Tariffs handout:

Let’s put it into playground terms and apply the same formula:

- The U.S. gives 10 chocolate chip cookies to the European Union, and the European Union gives 2 Oreos to the U.S. Then the U.S. applies these calculations:

- The U.S. states, “You’re charging us 80%, so we will charge you 40% more!”

Clearly, the logic behind this formula oversimplifies the complexity of global trade and macroeconomics. It also implies that the U.S. needs more Oreos because we consume more, and our cookies are worth more. But is that a fair assertion? We believe the real issue we’re facing is based on two factors: our huge budget deficit and our strong dollar.

Economic effects of the tariffs

Economists project that if average tariff rates increase from 2% to 25%+, inflation would increase by 1.3% over time. This does not account for businesses trying to maintain their profit margins, higher wage demands, and potential job losses. The market has responded quickly, input costs for manufacturers are rising, consumer prices are increasing, and corporate earnings are being revised downwards.

But, we’ve seen this darkness before, and we know that light always follows. Currently, inflation is at 2.8% and unemployment at 4.2%. Even if inflation rises to 4.1% and unemployment follows a bit higher, that’s still far healthier than the 9.1% inflation we endured in 2022.3 And one force consistently pulls us out: the U.S. consumer. When faced with economic uncertainty, American households somehow find a way to adapt and push forward.

Monetary and fiscal stimulus will likely follow. Facing pressure to decrease interest rates to spur economic growth, the Federal Reserve is expected to cut rates. Many economists are projecting four rate cuts this year, with the first expected on June 18, 2025. Fiscal stimuli could in the form of a stimulus check from the DOGE dividend and/or President Trump’s proposal to exempt tax on tips, overtime, and Social Security; to restore state and local tax deductions; or to introduce corporate tax breaks for domestic production.

Experience in safeguarding your investments

As we began 2025, we anticipated elevated uncertainty and proactively adjusted allocations to reduce risk, while remaining positioned for opportunities.

- Equities: Expecting increased volatility, we exited positions at the beginning of the year in our AI-focused fund and U.S. infrastructure fund. In turn, we bought global defense technology, believing geopolitical tensions would persist. In response to tariff developments, we implemented our de-risking policy, which is a comprehensive, disciplined process of evaluating our investments, portfolio positioning, and broader market conditions. This process led us to remove all small-cap growth stocks across portfolios, as this segment presented elevated risk. Throughout this period of market volatility, our thematic investments have demonstrated strong performance, and we expect them to continue delivering value as we move forward.

- Fixed income: To lessen duration risk and improve credit, we sold out of our core bond fund, chose a strategic bond fund, and added floating rate bonds and AAA CLOs — the highest rated tranches in the loan market. We also reduced corporate bonds to limit indirect equity exposure. Our conservative bond portfolios have served as the stable foundation we expect during periods of uncertainty. The strategy for these portfolios remains focused on higher-yielding bonds with lower risk profiles.

Familiar feeling, yet also different

The rhythm of the market beats on — volatility, correction, recovery. The cycle is familiar, yet the market circumstances are different. And as you move through this latest cycle of volatility, your partners at Potentia Wealth are ready to help you through it.

No one can control market downturns, so we focus on what we can control. And our focus at Potentia Wealth remains clear: analyze our positions, reassess risks, prepare for uncertainty, respond decisively to change, and stay grounded in long-term discipline. When we do this, we’re equipped to walk you toward financial health, encourage you to live confidently, and help you achieve your goals.

- YCharts. (n.d.). Market indices and statistics. YCharts. Retrieved April 14, 2025, from https://ycharts.com/indicators/categories/market_indices_and_statistics

- The Times. (2025, April 2). Trump announces tariffs on ‘Liberation Day’ — as it happened. The Times. https://www.thetimes.com/us/news-today/article/trump-tariffs-latest-news-announce-liberation-day-live-j3lftc33n

- Bloomberg. (n.d.). Economic calendar. Bloomberg. Retrieved April 14, 2025, from https://www.bloomberg.com/markets/economic-calendar

The provided information is for educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in any particular strategy.

The content is developed from sources believed to be providing accurate information. Potentia and Potentia Wealth do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Advisory services offered through Potentia RIA, LLC, an SEC-Registered Investment Advisor. Potentia RIA, Potentia Wealth, and Potentia are separate entities.

©2025 Potentia Inc.