Quarterly Investment Update: 4th Quarter 2023

By Kevin Swanson, CFP®

01/25/24

In July 2021, my wife and I flew to the Pacific Northwest to visit clients — putting her pilot’s license to good use! After completing our client meetings, we checked the weather forecasts and departed for home. We crossed through Washington and Oregon without issue, but as we entered California, the winds changed and smoke from the ongoing California wildfires was significantly worse than anticipated.

Soon, visibility was near zero, so we were completely dependent on our flight instruments. But even when flying by instrument, landing requires some visibility — and the nearby airports were at zero visibility. Finally, an airport just outside Sacramento temporarily became clear enough for us to land. We immediately shifted our flight plan, landed safely, and found a hotel where we could wait for conditions to improve.

An unexpectedly strong 4th quarter

Like the weather, financial markets can also be unpredictable. We started 2023 with a regional banking crisis and continued debt-ceiling discussions, and we ended the year with the Israel-Palestine conflict. Like most economists and market experts, we estimated a positive year-end for the stock market, but the 4th quarter of 2023 far surpassed market expectations. Why was this?

The unexpectedly strong Q4 performance can largely be attributed to three factors. First, the “Magnificent 7,” which are the seven S&P 500 companies that drove strong returns through the 3rd quarter, continued to outperform and hit new highs for the 4th quarter. Next, recession conditions became less favorable in light of the strong market growth. And, finally, strong economic data called into question the Fed’s assertion that rates would remain higher for longer, which led to a strong rally in the bond market as yields started to come down from their peak.

Bull market: Historical expectations for year two

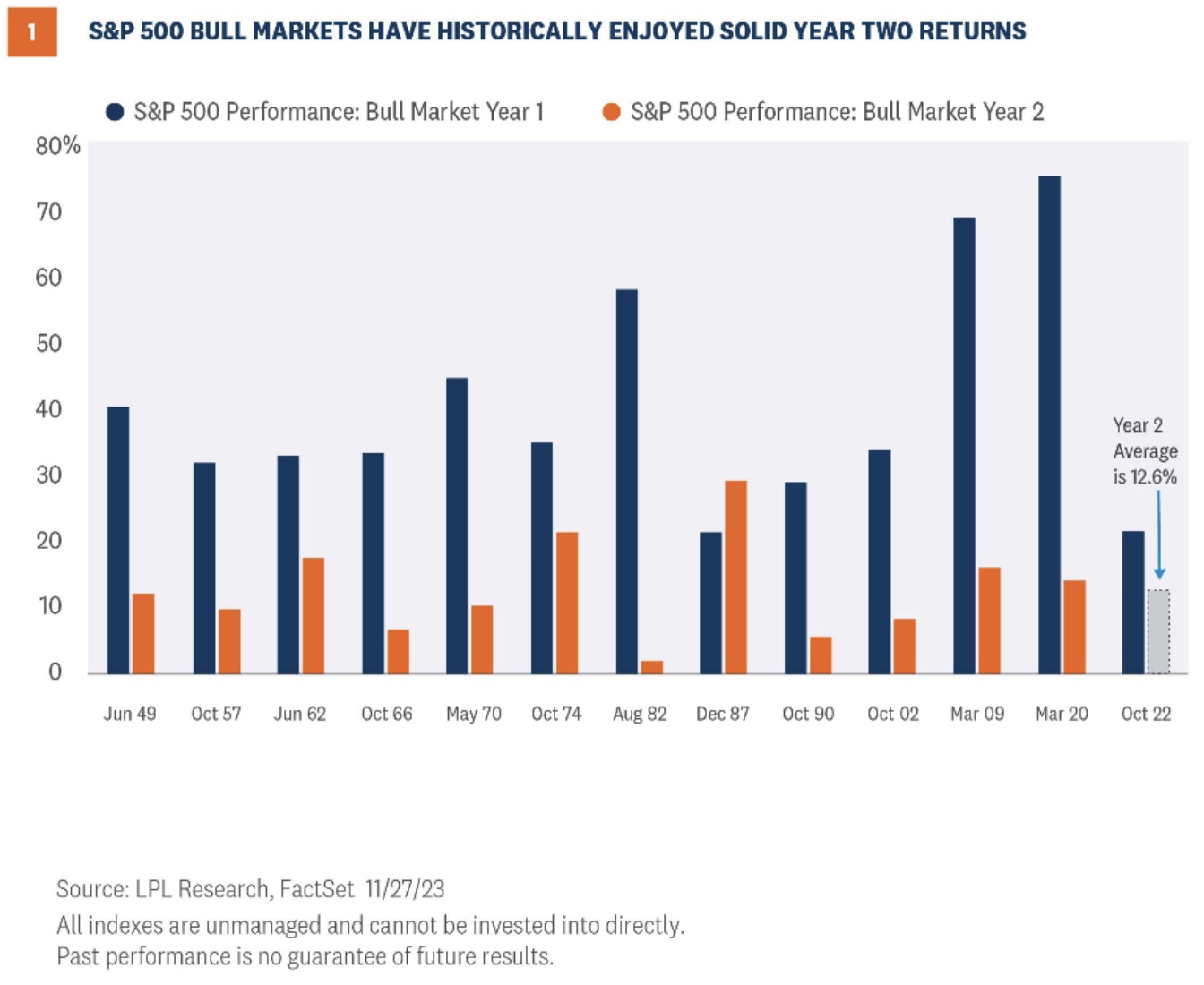

As illustrated in the chart titled, “S&P 500 Bull Markets Have Historically Enjoyed Solid Year Two Returns,” the second year of a bull market has underperformed the prior year 11 out of 12 times. Yet, the average second-year gains of 12.6% are still strong. And the positive economic data we are seeing indicates that the U.S. economy will continue to thrive, leading to positive growth in both stocks and bonds.

Yet, as we enter 2024, there are some notable cloudy patches to navigate before we can comfortably expect a 12.6% return: Geopolitical concerns, interest rates, and U.S. politics. So, although we are cautiously optimistic for 2024, we are keeping a close eye on the ripple effects of the Israel-Palestine conflict, any changes to the federal funds rate, and what promises to be a turbulent election in November. During uncertain times like these, we will rely more heavily on three key economic indicators — GDP, inflation, and unemployment — vigilantly searching for the safest place to land.

Strategies for safeguarding your portfolio

Even during a bull market, it’s important to safeguard your investments. And while we cannot eliminate the market volatility caused by global unrest, higher interest rates, or the political environment, we are constantly strategizing how to best maximize the efficiency of our clients’ portfolios.

- Equities: Given the uncertainties we’re facing, we’ll rely more heavily on the economic indicators of GDP, inflation, and unemployment to guide our investment decisions. Overall, we’re approaching foreign and domestic portfolios cautiously, as the geopolitical backdrop isn’t improving and the November elections could heavily affect U.S. markets.

- Fixed income: Our focus continues to be on when to lengthen the maturity of our bond holdings. While our portfolios had a 5-year average duration in 2023, we’ve since extended the duration to around six years, expecting decent appreciation if the Fed cuts rates this year as anticipated. If inflation drops near the Fed’s target, we can expect stocks and bonds to correlate positively. But with inflation still elevated, we cannot completely dismiss the possibility of upward pressure on interest rates.

Rely on our expertise

As we enter 2024, we may be facing cloudy conditions, but we aren’t flying with zero visibility. While the clouds are too thick to know from a distance how the markets will respond, our trusted economic indicators are guiding us until we determine a safe landing path. And while no one enjoys uncertainty, the Potentia investment team has a track record of successfully navigating turbulent markets — most recently in 2023!

The provided information is for educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in any particular strategy.

The content is developed from sources believed to be providing accurate information. Potentia and Potentia Wealth do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Investment advice offered through Mariner Independent Advisor Network, a registered investment advisor. Mariner Independent Advisor Network, Potentia Wealth, and Potentia are separate entities.

©2024 Potentia Inc.