When growing up in California’s Central Valley, you learn to adapt to two things: the excruciating heat in the summer and the tule fog that blankets the region during the winter. Tule fog, named after tule grass that grows by California marshes, is widely considered one of densest fogs in the world. And while driving through dense fog can be unsettling, there are clear steps to take: (1) focus on the road, (2) look for guiding signs, (3) make adjustments as the conditions change, and (4) exercise patience. By taking these safety precautions, drivers are more likely to reach their destinations safely.

Navigating the current economy and financial markets can feel a bit like driving in low-visibility, foggy conditions. It’s hard to see what lies ahead. It’s unnerving. And it requires patience. But we shouldn’t be surprised by these uncertain market conditions — in fact, they are to be expected. Potentia Wealth’s methodical, strategic, long-term investing strategies are built to weather times like these.

Focus on what we know: The facts

As we begin the first quarter of 2025, we are facing multiple layers of uncertainty: The transition to a new administration, ongoing global conflicts, persistent inflation, and an increasingly unpredictable trajectory for interest rates. And while speculation abounds, there isn’t much clarity.

During these times, it’s essential to focus on what is certain, while staying anchored to fundamentals. Here’s what we know:

- The economy remains robust, which means inflation expectations continue to linger.

- The presidential election results caused a shift in the financial markets, particularly within the bond market.

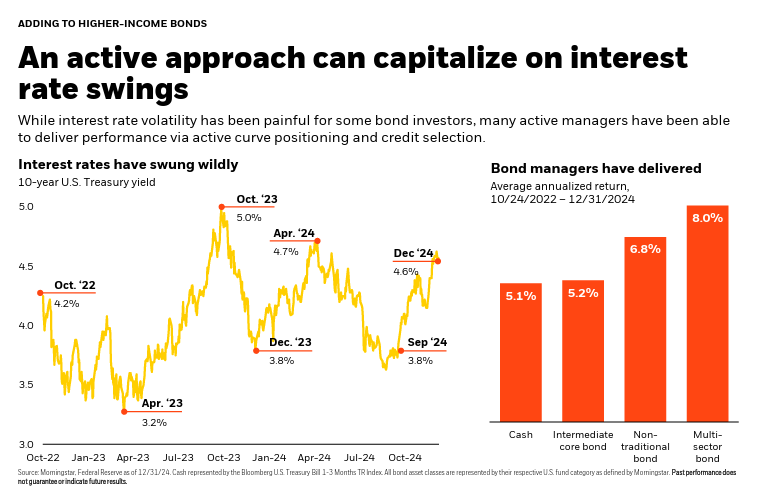

- The Federal Reserve implemented three rate cuts (totaling 100 basis points) over the course of the year, causing a decline in bond yields from earlier highs.

- The new administration’s post-election proposals introduced the possibility of rates remaining higher for longer, driving investors to demand higher yields for long-term bonds.

- The impact of tariffs remains a key focus, as markets assess their effects on economic growth, corporate profits, and consumer spending.

When we rely on the facts, we can use that knowledge to adjust client portfolios accordingly. For example, the chart titled, “An active approach can capitalize on interest rate swings,” illustrates how active managers can take advantage of a seemingly negative situation like interest rate volatility.

Look for guiding signs: The historical patterns

As the saying goes, there’s nothing new under the sun. And that adage certainly applies to market cycles. When navigating uncertain market conditions, it can be helpful to remember their cyclical nature.

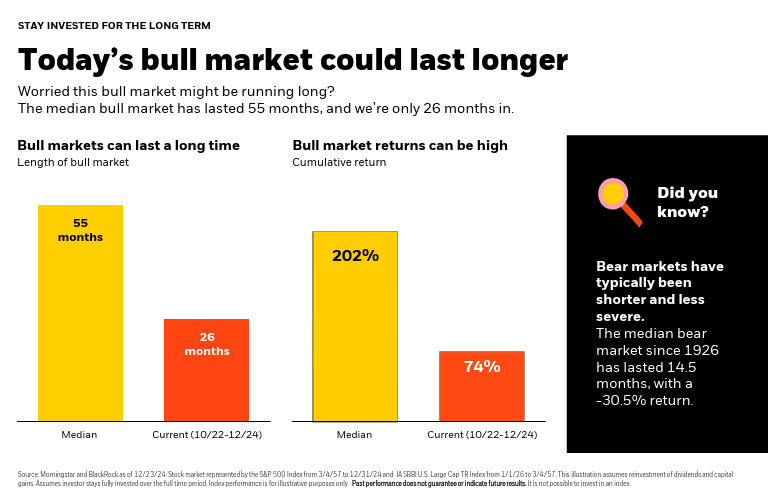

Historical trends show that markets generally rise over time. This doesn’t mean every year will be positive, but the long-term trajectory matters. Staying invested through the ups and downs increases your chances of reaching your financial destination. But we know that can sometimes feel uncomfortable, which is why we encourage clients to reach out whenever they have concerns — it’s important to walk through these situations together.

In addition, the current uncertainty can cause us to lose sight of the fact that we are still in the midst of a bull market. The chart titled, “Today’s bull market could last longer,” reminds us that the median length of a bull market is 55 months, and we’ve just entered the 28th month. Of course, we can’t predict how long this bull market will last, but sometimes reminding ourselves of historical trends can ease concerns and provide clarity.

Adjust our portfolios: The benefit of active management

Potentia builds diversified client portfolios by blending three investment components: (1) core equity, (2) stable fixed income, and (3) thematic opportunities that pursue sector-specific trends. Then we actively adjust investments within these pillars, depending on market performance and potential opportunities.

- Core equity: The equity positions within our core portfolios are currently well aligned with our strategy, so we don’t foresee significant changes. These portfolios maintain a slightly higher allocation toward growth, consistent with the broader market positioning. One way we achieve this is by holding the three largest market cap stocks, allowing us to capture a higher risk profile in bull markets, while minimizing the downside during market corrections.

- Stable fixed income: Within our fixed income pillar, we’ve adjusted holdings to prepare for interest rates to remain higher for longer. We’re actively working to lower maturity, while also increasing yields. This strategy seeks to minimize volatility by providing steady yields.

- Thematic opportunities: One sector-specific trend we’re investing in is artificial intelligence (AI). The AI boom remains strong, continuing to bring new investment opportunities as companies race to claim their spaces within AI. For our more aggressive investors, we recently invested in a data center fund that seeks to capitalize on big tech’s frenzied push to build out AI infrastructure.

Rest assured, we are constantly monitoring market performance, researching trends, and searching for potential opportunities — that’s the benefit of active management.

Exercise patience: The fog always lifts

Whether you’re driving through tule fog or navigating uncertain financial markets, the strategy is the same: Focus, look for guiding signs, make adjustments, and exercise patience.

As your partner in this journey, our job is to help guide you through the obscurity, evaluate your portfolio regularly, and recommend investment adjustments. The most important thing to remember is to stay the course by keeping a long-term outlook. Because while the fog may linger awhile, it always lifts.

The provided information is for educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in any particular strategy.

The content is developed from sources believed to be providing accurate information. Potentia and Potentia Wealth do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Advisory services offered through Potentia RIA, LLC, an SEC-Registered Investment Advisor. Potentia RIA, Potentia Wealth, and Potentia are separate entities.

©2025 Potentia Inc.