History Lesson or Something Historic?

By Richard Schooley

02/7/21

Opportunity will come with volatility

A Financial Times article recently cited Seth Klarman, a respected hedge fund manager, who characterized the current economic moment in the following way, “With so much stimulus being deployed, trying to figure out if the economy is in recession is like trying to assess if you had a fever after you just took a large dose of aspirin. But as with frogs in water that is slowly being heated to a boil, investors are being conditioned not to recognize the danger.”

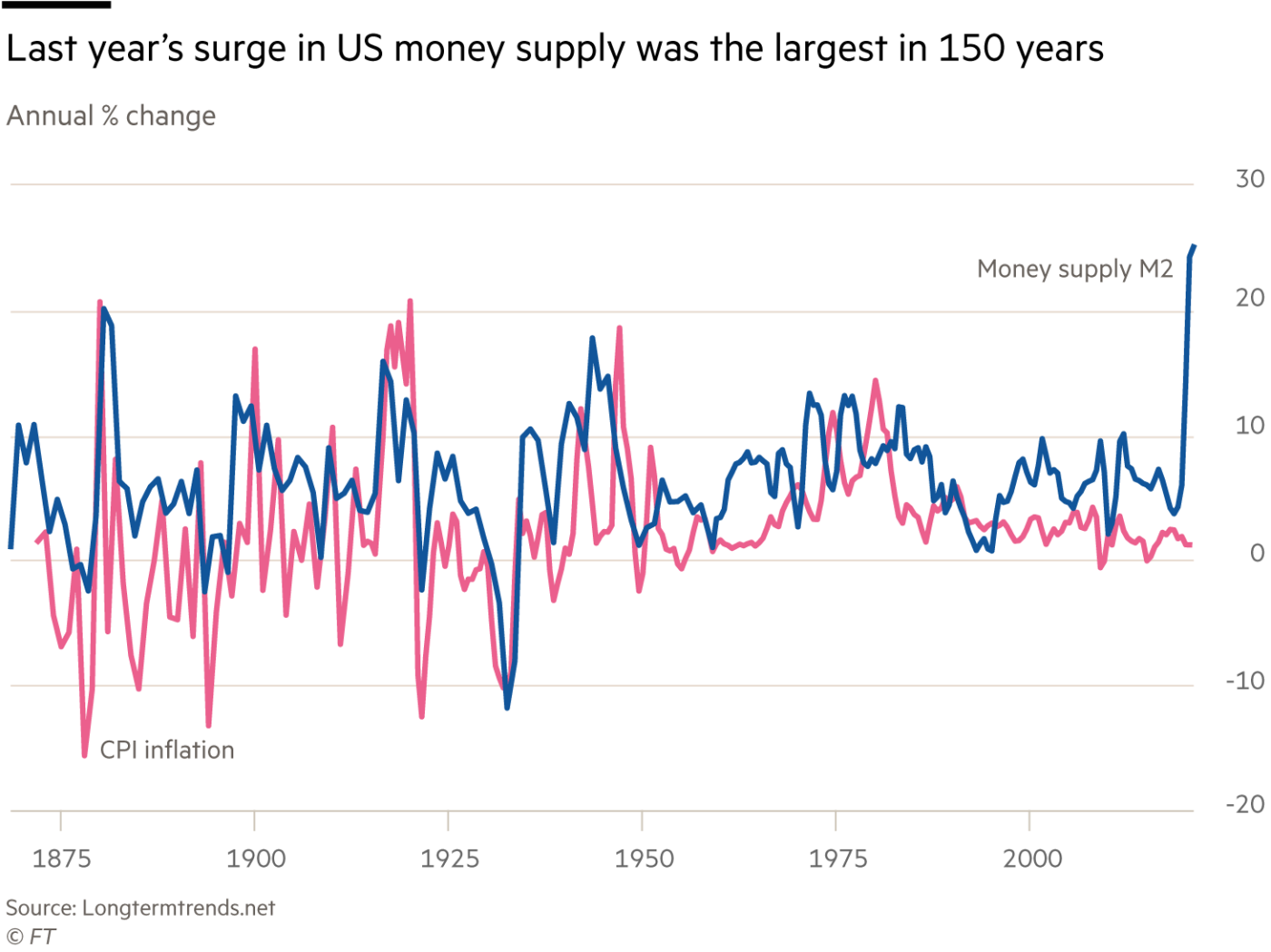

In fact, as investors right now we need to heighten our attention to risk and potential rewards. History holds some lessons for us even as we are witnessing something historic. Typically, in recessions financial conditions tighten, but the opposite has taken place in the last year. Instead, money supply has surged as a way to bridge to a vaccinated future. One result of stimulus packages and the Fed’s monetary policy is greater M2 Money Supply than we have ever seen. Why does that matter?

M2 Money

Let’s define terms first. M1 money includes money in circulation and checking deposits in banks. M2 includes M1 plus a broader set of financial assets held principally by households, including savings deposits less than $100,000 and money market mutual funds. Historically, M2 has grown along with the economy. However, it has also grown along with Federal Debt-to-GDP during wars and recessions. Following such periods of M2 growth, there was strong economic growth.

After WWI, for instance, came the Roaring 20’s. Following WWII, we experienced one of the longest economic expansions and bull markets in history. More recently, M2 growth surpassed 10 percent in the crises of 2001 and 2009, during which an expansionary monetary policy was deployed by the Central Bank, including large scale asset purchases. What followed was a decade of economic growth and bull markets in both cases.

Yet, the last 12 months ranks as one of the most significant economic events in history. Why?

During the pandemic, consumers have been unable to spend money. Simultaneously, the US Government injected massive stimulus into the economy. In less than a year, M2 has grown in excess of 26%. And we are not done. With another $1.9 trillion package currently being discussed in Washington DC, we could see M2 jump again—creating a very strong economic outlook, based on historical experience.

It will not come without some volatility.

A strong fiscal economy brings with it the potential increase in inflation and interest rates. According to Bannister and Forward (2002), money supply growth and inflation are inexorably linked. This was especially true prior to 1980, though the Fed has kept inflation largely in check for the last 40 years. While we do expect to see more inflation and increasing interest rates over time, there is serious doubt the Fed would allow a hyper-inflation economy last seen in the 70’s, resulting in a decade of stagflation.

We’re in a moment to apply financial lessons from history; however, we’re also in an historic moment that is unprecedented. Let’s keep in close contact, review your portfolio, assess your risk tolerance and fine tune it all. With a few adjustments, it’s possible to see impressive returns over the next few years.