Quarterly Investment Update: 1st Quarter 2024

By Potentia Wealth

04/15/24

Dating back to 1875, the Kentucky Derby isn’t just a horse race — it’s a cultural phenomenon that blends athleticism, tradition, and style in a single event. On May 4, thousands will converge on Churchill Downs wearing elaborate hats and outfits, sipping on mint juleps, and soaking in the many festivities surrounding the annual “Run for the Roses.”

The overall goal directs the underlying strategy

So how does the Kentucky Derby relate to the financial markets? In a word, strategy. Just as trainers meticulously prepare their horses for race day, investment professionals spend hours analyzing market trends and company performance to make informed decisions. Just as jockeys optimistically and carefully guide their mounts to the finish line, investors ride similar waves of optimism and uncertainty. And just as a winning horse can yield lucrative rewards, so can a successful investment strategy.

Of course, there’s an important difference between horse racing and investment planning — whereas the Kentucky Derby lasts only two minutes, financial plans must be strategically built to last a lifetime. So, while short-term results do matter, our primary objective is to methodically meet our clients’ long-term goals.

Strong returns out of the starting gate

At the beginning of every year, we meet with various strategic partners to gauge Wall Street’s market sentiments and predictions. Put simply, economists are overwhelmingly bullish for 2024. For example, market experts are predicting the S&P 500 to reach 5,300 during 2024.

And the markets certainly delivered during the first quarter. Since November 2023, we’ve had five consecutive months of positive returns, with many companies posting all-time highs. Wall Street responded favorably to the Fed’s December assertion that rate cuts are coming. The S&P 500 notched a record high of 5,254.35 just before Easter weekend. And with a whopping 303,000 jobs added in March, unemployment fell slightly to 3.8%.

Market volatility likely before the final furlong

As the S&P 500 quickly approaches its predicted peak of 5,300, many economists are wondering if we’ll see returns dip in the coming months. While we continue to believe that 2024 will deliver positive returns, we do expect some volatility along the way.

The federal funds rate stands at 5.3%, unchanged since July 2023, as the Fed presumably waits for inflation to trend back toward its 2% target. If the Fed continues to postpone rate cuts, the bond market could react unfavorably because it’s already priced in approximately three rate cuts for this year. And, as discussed in our March article, the upcoming presidential elections could contribute to market volatility as well. [link to: https://potentiawealth.com/discussing-politics-and-the-markets/]

Making sense of volatility, market drawdowns, and year-end returns

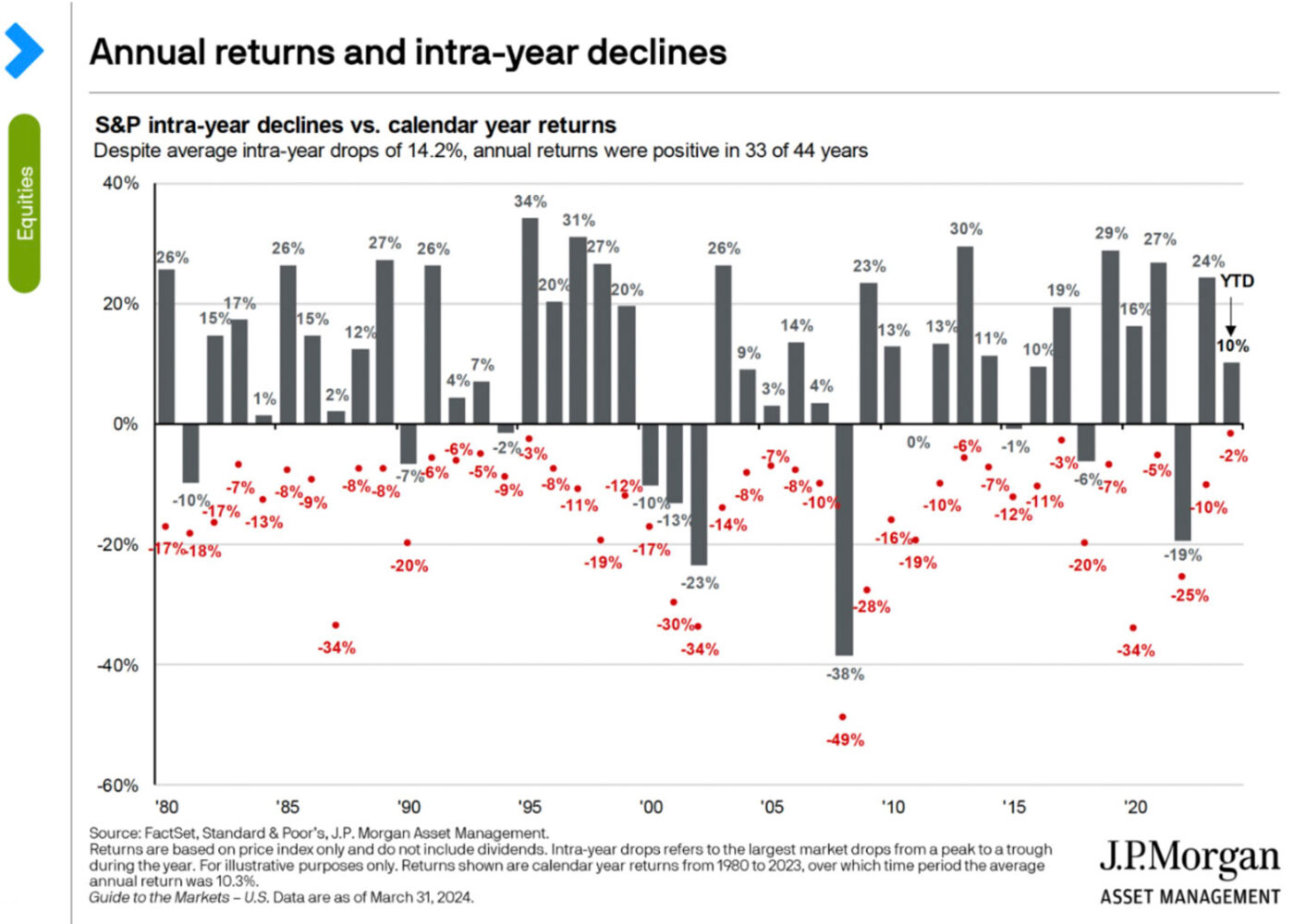

So, how can we end the year positive, but also experience market volatility? The chart titled, “Annual returns and intra-year declines,” shows how volatility doesn’t necessarily result in negative year-end returns. The gray bars represent annual returns since 1980. The red dots plot the largest market drop (from a peak to a valley) within the year, which is also known as the market drawdown. And although most years posted positive year-end returns, every year experienced a market drawdown at some point due to market volatility.

The chart also illustrates that election years generally experience greater volatility. Since 1980, the average market drawdown during election years was –16.3%, compared to –13.5% in non-election years.* And because election-year volatility generally occurs in the months leading up to the election, it’s surprising that the largest correction so far in 2024 was only –2%.

Hedging our bets by safeguarding portfolios

Whether we’re in a bull or bear market, we’re continually working to position client portfolios to withstand volatility. And while our outlook for 2024 is positive, we’re carefully monitoring how the market responds to variables like the presidential election, inflation, geopolitical uncertainty, and potential interest rate cuts.

- Equities: Overall, we expect positive equity performance. One area that has significantly fueled the robust U.S. economy is artificial intelligence. We invested in Nvidia during the first quarter, and subsequently broadened our exposure to other companies focused on AI development and infrastructure.

- Fixed Income: With anticipated rate cuts bolstering the fixed income markets, we’re closely tracking the same economic indicators the Fed uses to make rate-cut decisions: GDP, inflation, and unemployment. But because these indicators have remained largely unchanged since October 2023, we’re patiently watching and waiting for positive movement.

Rely on our track record

As we anticipate the excitement of the upcoming Kentucky Derby, let’s remember that amidst the pageantry and pulse-pounding action, there are parallels to the world of finance. Whether you’re cheering for your favorite horse or monitoring your stock portfolio, both endeavors share the thrill of competition and the hope of victory.

At Potentia Wealth, we have a time-tested track record of building strategic investment plans that help clients achieve long-lasting financial health. But, unlike horse racing, it’s the long-term victory we seek for our clients, day in and day out. After all, while some people pick stocks for hobby and sport, our recommendations not only influence the futures of our clients, but also their legacy.

*Source: J.P. Morgan Asset Management, “Election overview: How volatile are markets during an election year,” http://am.jpmorgan.com/us/en/asset-management/adv/insights/market-themes/us-elections, 4/3/24

The provided information is for educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in any particular strategy.

The content is developed from sources believed to be providing accurate information. Potentia and Potentia Wealth do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Advisory services offered through Potentia RIA, LLC, an SEC-Registered Investment Advisor. Potentia RIA, Potentia Wealth, and Potentia are separate entities.

©2024 Potentia Inc.