Post-Pandemic Economy: A Repeat of Post-World War II?

By Kevin Swanson, CFP®

05/24/23

I’ve always been intrigued by and curious about trends and patterns around us. Maybe that’s why I find such enjoyment in searching for the cycles and themes within economics and finance. And while many investors consider the financial markets to be erratic, they are actually quite cyclical and predictable.

Warren Buffet once said, “What we learn from history is that people don’t learn from history.” Essentially, rather than relying on the historical predictability of economic patterns, investors are more likely to let their emotions and fears guide them.

Taking a cue from Buffet, why don’t we reverse this human tendency and endeavor to truly learn from history? Specifically, as we trudge through the post-pandemic economy, I’m reminded of the World War II economy — another time in history when the American economy boomed, but was followed by a period of recovery.

World War II economy: Focused on wartime goods

In the 1930s, America was in the throes of the Great Depression — until World War II began in 1939. Wartime economies are usually strong, but the American economy during World War II experienced significant growth. This largely resulted from America’s ability to quickly engage and adapt its workforce, while shifting its industrial resources to begin producing wartime goods like aircraft, ships, military supplies, and food exports.

World War II not only pulled America out of the depression, but it enabled America to emerge with the world’s strongest economy, solidifying its global power.

Pandemic economy: Focused on consumer goods

As we entered the 2020 Covid pandemic, fear and uncertainty quickly gave way to an unprecedented spending spree on products and goods. Without travel, restaurant, and entertainment options, Americans began to spend their income and stimulus money on goods instead of services.

Chasing the seemingly insatiable demand for goods, manufacturers attempted to boost production by adapting their business models and workforces. This resulted in a decisive shakeout among businesses — certain companies quickly rose to the top, while many went out of business. Further exacerbating the situation, the supply chain simply couldn’t keep up with demand.

While the 2020 Covid pandemic proved devastating on many levels, the consumer economy was the bright spot — it began to boom.

Emphasis on goods instead of services

When we compare the soaring World War II and pandemic economies, the common theme is that both were fueled by a shift toward goods and away from services.

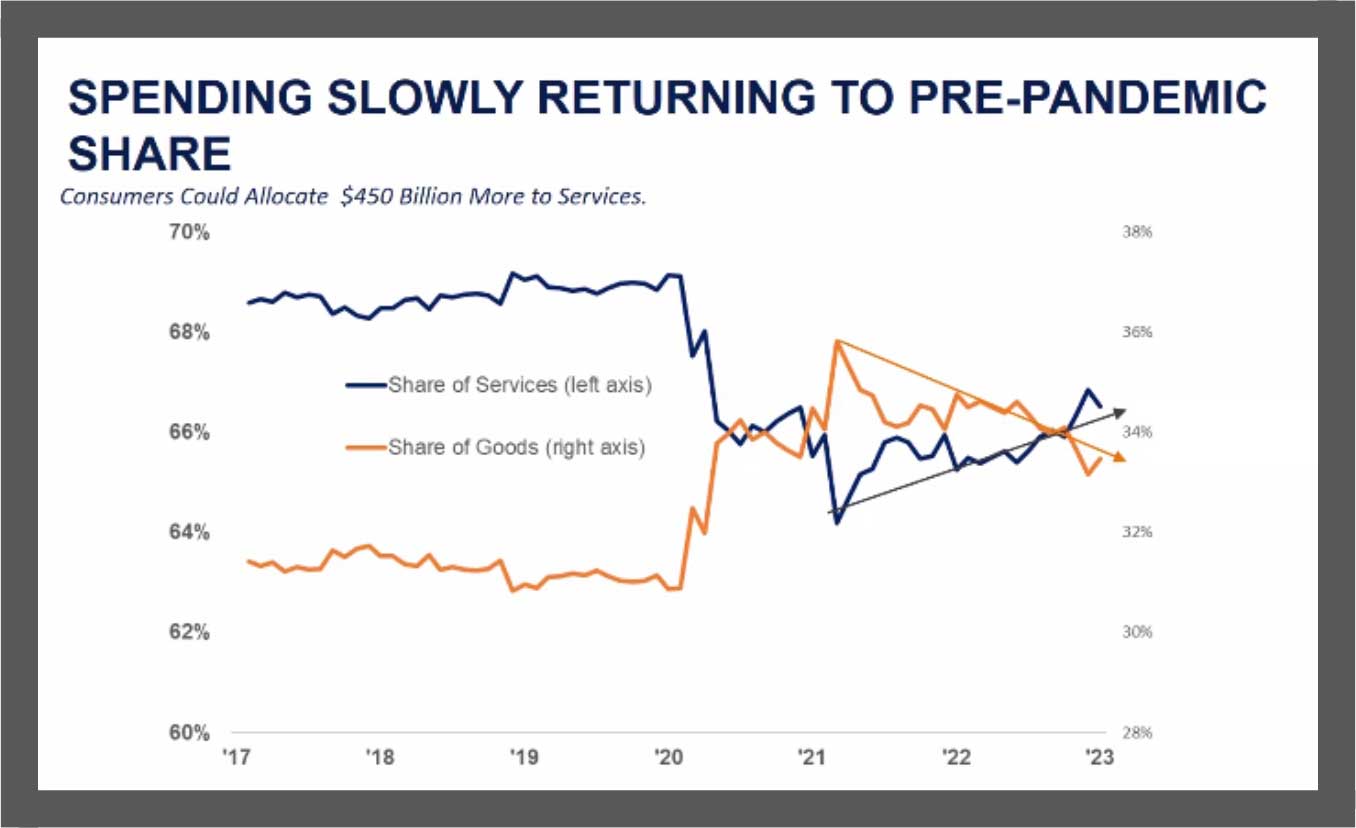

As illustrated in the chart titled, “Spending Slowly Returning to Pre-Pandemic Share,” we generally spend more on services than on goods. But during both World War II and the pandemic, these spending patterns flipped — we spent more on goods than services.

Source: LPL Research, Bureau of Economic Analysis, 2/24/23

Toward the end of 2022, the chart shows spending gradually shifting back toward services and away from goods. Yet to restore the balance of pre-pandemic spending patterns, consumers would need to allocate another $450 billion toward services — and that will likely take another 18 – 24 months, at minimum.

Will history repeat itself?

Given the similarities between the World War II and pandemic economies, it’s logical to assume that both would experience similar periods of correction, as the balance of goods to services is restored.

The World War II economy grew steadily during the war, peaking from 1945 – 1946. Following the war, demand began shifting away from wartime goods and back toward civilian products and services. And while this recovery period began in 1946 and lasted around 5 – 6 years, it was followed by a bull market that was arguably the strongest we’ve ever experienced.

Fast forward to 2023, and life has resumed a normal, pre-pandemic cadence for most people. But because of significant inflation, the Federal Reserve’s priority has been to curb inflation — raising the federal funds rate 11 times since March 2022. Inflation is finally stabilizing, but the rate increases are also reigning in consumer spending, causing the economy to cool off. And that’s why many economists say we’re on the brink of a mild recession.

Expecting a shorter correction period

The World War II economy was characterized by growth, recovery, and then almost two decades of bull-market growth. Similarly, the pandemic economy experienced growth and we’re now in the midst of a recovery. Whether we enter a bull market is yet to be seen, but that would certainly be a welcome outcome!

So, will this post-pandemic correction take 5 – 6 years, like the World War II recovery? We don’t think so. Because pandemic spending shifted the economy toward goods and away from services, it will take some time before these two areas achieve a healthy balance again and the supply chain fully recovers. But given the stability within employment — perhaps the most important indicator as to how deep a recession might be — we expect this period of economic contraction to be relatively mild and relatively short.

Let’s prove Warren Buffet wrong — instead of letting emotions or fears mislead us, let’s learn from history and take comfort in the historical predictability of our economy.

The content is developed from sources believed to be providing accurate information. Potentia and Potentia Wealth do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Investment advice offered through Mariner Independent Advisor Network, a registered investment advisor. Mariner Independent Advisor Network, Potentia Wealth, and Potentia are separate entities.

©2023 Potentia Inc.