Three Reasons We Are Not in a Housing Bubble

By Potentia Wealth

03/29/22

My daughter and son-in-law are looking to move from their townhouse to a larger home with a yard. There are few homes available, and they have been making offers on the ones that are available without success. The multiple-offer competition is coming in all cash and as much as 20% above asking. They are concerned about making an offer 20% above asking as they could be buying at the top of the market. Like many, they are wondering if we are nearing a real estate bubble pop!

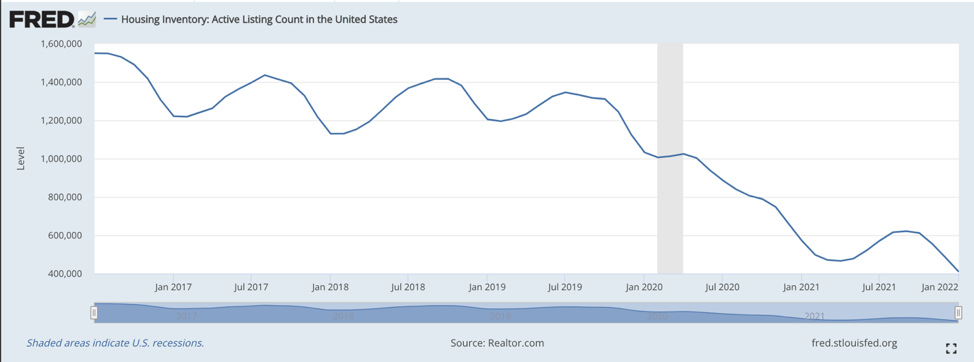

This is a nationwide phenomenon and not just in the San Francisco Bay Area. Potentia Wealth represents clients nationwide, and in every case, our clients are experiencing limited houses available for sale and high demand, which continues to drive prices higher. So, what is causing this phenomenon and how long will it last?

Blame the Boomers?

According to the U.S. Census Bureau, in 2019, the percentage of homes that were owned by those over 55 years of age (boomers) was 53.8%, despite representing only 28% of the population. In a 2018, a survey conducted by AARP found that 76% of Americans over the age of 50 would prefer to remain in their current home rather than move in with family or a nursing home or assisted living facility, which is leading to less inventory for new buyers.

Today, people are healthier, living longer, remaining more social and active, and in many cases, still working. They are not downsizing their homes as much and they are finding new ways to age in their home safely and independently. So, is the lack of inventory the boomer’s fault then?

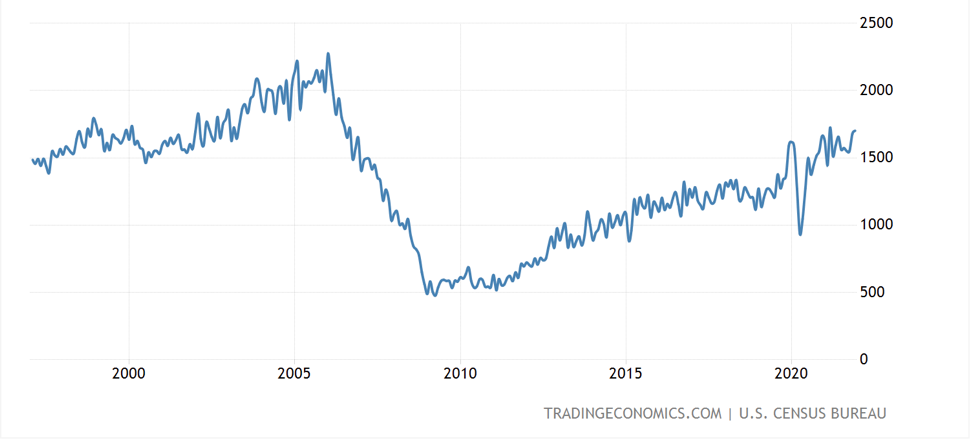

While boomers do control a large portion of the existing real estate for a longer time than in the past, new homes are not being built at the same rate as prior to 2008. According to the U.S. Census data, prior to the Great Recession, the ratio of new population to home construction was about 2:1, meaning two people were added to the population for every new home built. That ratio increased to 5:1 after home construction dropped more than 50% after 2007. The Construction Progress Coalition estimates that there are 3.8 million homes short of meeting today’s demand. While new home starts are increasing each year, it is estimated it will take 10 years to catch up with demand.

Lack of Skilled Tradespeople

After the Great Recession of 2008, the construction industry quit building as many homes. According to building permit data from the U.S. Census, home construction has decreased by 55% nationwide. Many of the skilled construction tradespeople moved to other industries to find employment. Along with the push for our children to complete a four-year college degree, not as many people are being trained to work in the construction industry. The U.S. Bureau of Labor Statistics estimates that the overall employment of construction laborers and helpers is projected to grow 7 percent from 2020 to 2030, about as fast as the average for all occupations. About 167,800 openings for construction laborers and helpers are projected each year, on average, over the next decade. It’s going to take a long time to rebuild the workforce necessary to catch up with the housing demand.

(NIMBY) – Not In My Back Yard

It is also getting more difficult to find land on which to build the homes we need. One solution to this problem is building higher density housing in or around our existing neighborhoods. When we are looking for a home, we are frustrated by the lack of housing available, however, as soon as we become homeowners, we become very resistant to changing the neighborhood to allow more people to live there. We are all in favor of more housing, however, just not in my backyard. It is very difficult for states, counties and city councils to create change allowing more housing because the very people who are supposed to create that change are also those who live in the neighborhood.

The housing problem is complex, and today’s housing shortage has been a creation of multiple factors over the last 20 years. The population in the United States continues to grow, we are living longer, healthier and more productive lives in our homes, we have a shortage of skilled labor to build our homes and we are reluctant to allow more people to live in our neighborhoods. All these factors lead to a continuing increase in demand for housing at a time when the supply of housing is limited, and we believe will continue to be so for many years to come. Even with the future expected interest-rate increases, which we believe will help to equalize the imbalance between supply and demand, we currently do not see a real estate bubble.